The Rs 1,039.61 crore IPO of CE Info Systems (MapmyIndia) kicked off today

Published On: Thursday, December 9, 2021 | By: Team KnowMyStock

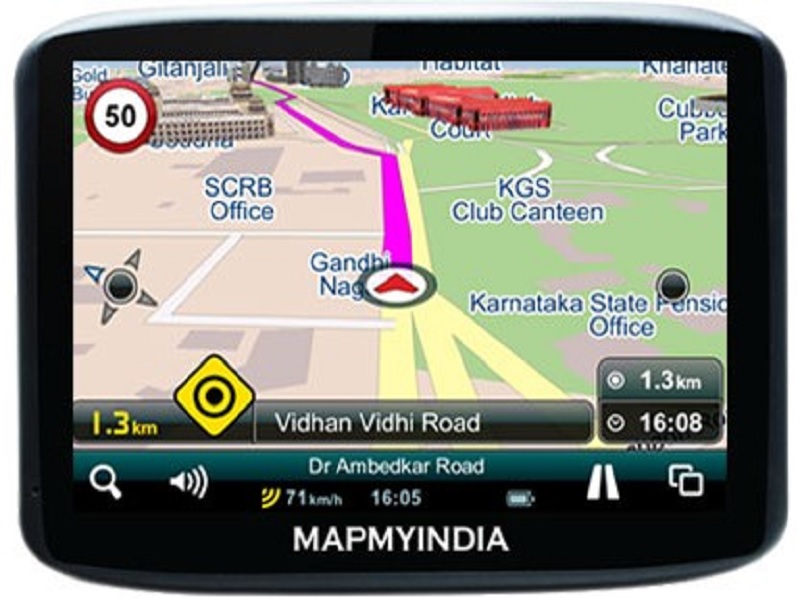

The company has fixed the price band for the stake sale at Rs 1,000-1,033 apiece and investors can bid for a minimum of 14 shares and then in multiples thereof. The majority of the brokerage houses have suggested investors subscribe to the issue, thanks to its high growth potential, conservative valuations, robust client base, and entry barrier to the business. Founded in 1992, MapmyIndia is a leading provider of advanced digital maps, geospatial software, and location-based IoT technologies in India. While consumer-based apps like Google Maps are free, API and enterprise-based solutions are paid services and the company has an edge due to its maps being more accurate compared to peers, said Reliance Capital in its IPO note.

"The company aims to develop and innovative its technological capabilities, with a broader stack of software products," the brokerage said while assigning a subscribe rating on the issue for the long term on the back of its high growth potential, increasing usage of new technology platforms by customers, minimal competition and valuation comfort.

Meanwhile, Arihant Capital, which has a subscribe rating on the issue, said that at the upper range of price band, the issue is priced at a P/E multiple of 94x based on the FY21 EPS. The company has strong fundamentals and its profitability is expected to inch up going further, it added.

It is the market leader in the digital maps and geospatial software industry, effectively creating an entry barrier against potential competition. Its long standing relationships with high value clients not only generate repeat sales, but also encourage cross-selling and up-selling," it said.

MapmyIndia has certain advantages as its digital maps and other solutions are localised for the challenging Indian geography and are extensive in terms of coverage.

50 per cent of the net issue is reserved for qualified institutional buyers (QIBs), whereas non-institutional buyers will have 15 per cent of shares allocated for them. Retail portion has been fixed at 35 per cent of the offer.

We are on Telegram!

JOIN our telegram channel to receive updates on Financial News and Stock and FNO Tips.

Click Here!

Follow Us On: