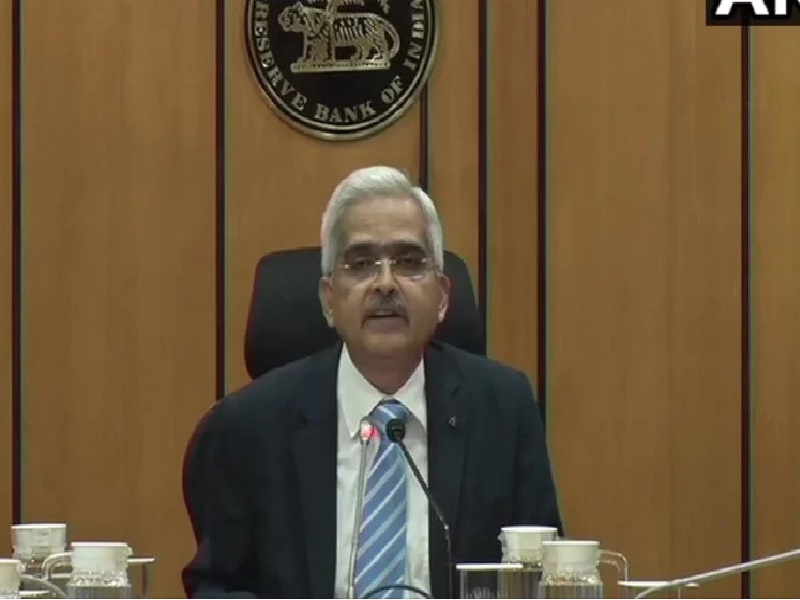

RBI's Monetary Policy Committee expected to hold rates and continue with an accommodative stance to encourage growth

Published On: Thursday, June 3, 2021 | By: Team KnowMyStock

The RBI is expected tomorrow(4th June 2021) to hold interest rates after a three-day meeting of its Monetary Policy Committee (MPC). The policy will likely maintain an accommodative stance, as helping economic growth remains a priority. Here are key decisions to look at from the review meeting: The market will look out for RBI’s GDP growth forecast for the financial year. In the last policy review meeting of April, GDP growth for the current financial year was projected at 10.5%. For the first quarter, it was projected at 26.2%. The prediction was before the second wave of the coronavirus pandemic that has hurt economic activity due to lockdowns by state governments. Most economists and rating agencies have trimmed their forecasts following the second wave. Many see GDP growth for FY22 in single-digit now, as compared to double-digit predictions made before the second wave.

“RBI is expected to revise growth projections downward but not significantly,” and we are at 8.5% as compared to the 10.2% projected earlier. (FY22) The RBI will possibly keep FY22 GDP growth projections between 9-9.5%,” they say.

We are on Telegram!

JOIN our telegram channel to receive updates on Financial News and Stock and FNO Tips.

Click Here!

Follow Us On: