RBI leaves key interest rates unchanged;economy better prepared to deal with Covid, says RBI Governor

Published On: Wednesday, December 8, 2021 | By: Team KnowMyStock

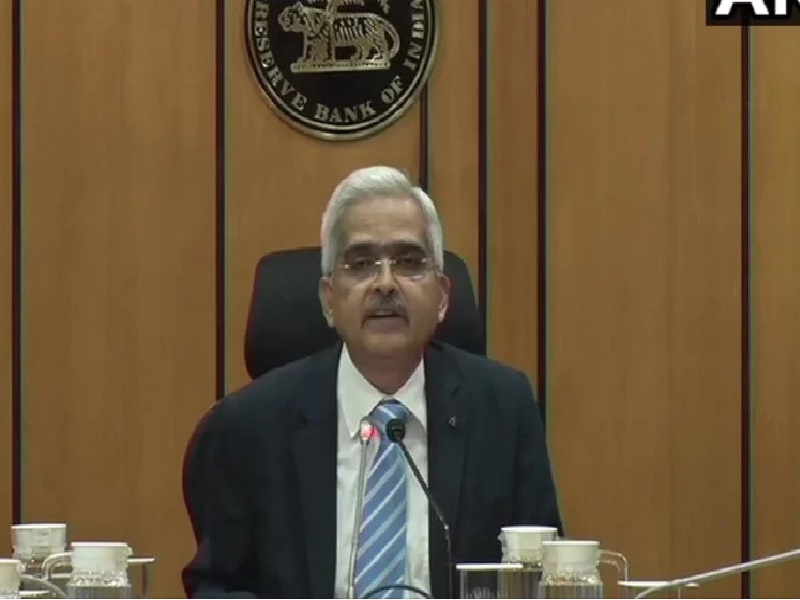

The Reserve Bank of India’s monetary policy committee (MPC) today(8th December 2021) maintained key interest rates for a ninth straight meeting, retaining an accommodative stance amid the threat surrounding the Omicron coronavirus variant. Repo and reverse repo rates remain unchanged at 4 percent and 3.35 percent, respectively, said RBI governor Shaktikanta Das in a statement after a three-day meeting of the committee in Mumbai. The central bank maintained its FY22 GDP forecast at 9.5 percent and projected retail inflation to be at 5.3 percent. "Indian economy hauled itself out of its deepest contraction; we are better prepared to deal with Covid-19,” said the RBI Governor. "Given the slack in the economy and the ongoing catching up of activity, especially of private consumption, which is still below its pre-pandemic levels, continued policy support is warranted for a durable and broad-based recovery," he said.

"Based on an assessment of the macroeconomic situation and outlook, the MPC voted unanimously to maintain the status quo with regard to the policy repo rate and by a majority of these 5-1 to retain the accommodative policy stance."

India's economy expanded 8.4 per cent in the September quarter from a year earlier, the fastest pace among major economies, but economists said disruptions from the new virus variant risked slowing the recovery.

Inflation has been within the RBI's 2-6 per cent target range due to the cuts in taxes on fuel by central and local governments, but the damage to perishable food items due to unseasonal heavy rains and telecom price hikes are likely to push inflation up yet again.

Tags: he Reserve Bank of India’s monetary policy committee report India's economy RBI's target range of Inflation

We are on Telegram!

JOIN our telegram channel to receive updates on Financial News and Stock and FNO Tips.

Click Here!

Follow Us On: