RBI hints at normalising ultra-loose policy

Published On: Friday, August 6, 2021 | By: Team KnowMyStock

The August review of the Reserve Bank of India’s bi-monthly monetary policy was interesting as: 1.) no unanimous voting on the policy stance 2.) more than expected revision in inflation forecast for FY22 and 3.) announcement of the variable rate reserve repo auction – an indication that the central bank has started the gradual withdrawal of the ultra-loose monetary policy that was in place since the onset of the Covid-19 pandemic. As expected, there was complete unanimity among all the six members of the monetary policy committee (MPC) to keep the interest rate unchanged at 4%. However, on maintaining the accommodative stance, five of the six members voted in favour. Professor Jayanth Verma disagreed.

The announcement of variable rate reverse repo auction to suck out liquidity is the measure which the bond market interpreted as a sign that the central bank is moving towards policy nomalisation, though Governor Das categorically said the measure should not be read as a reversal of the accommodative stance.

The bond market reacted following the announcement, as the yield of the 10-year benchmark government bond shot up to 6.24 percent from 6.20 percent.

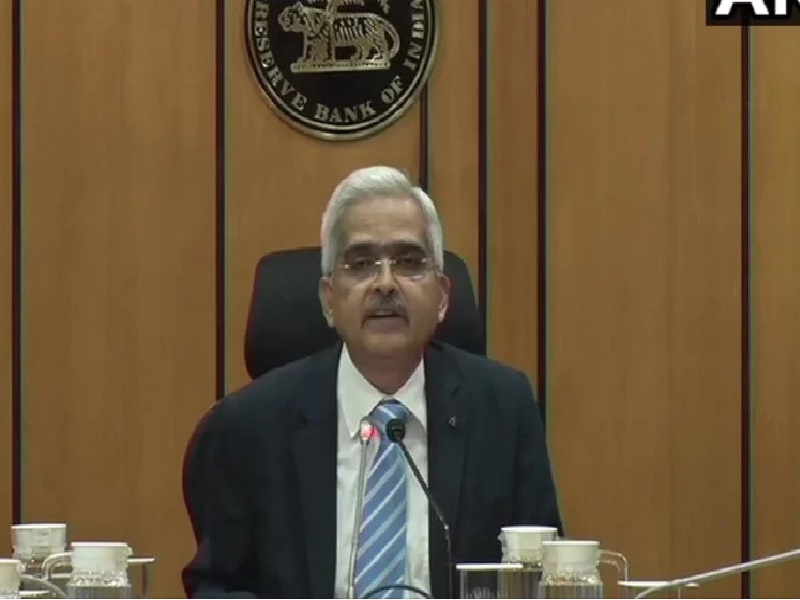

RBI Chairman, Shaktikanta Das, is probably just about preparing the market in the event that the third wave does not happen and growth which is slightly looking better than earlier anticipated according to the RBI, the RBI may actually be readying for normalising some bits of the monetary policy. He is also trying to calm the markets by saying that we are still in relatively uncertain times and hence the continuation of the stance will extend till a durable and sustainable recovery in growth happens.

We are on Telegram!

JOIN our telegram channel to receive updates on Financial News and Stock and FNO Tips.

Click Here!

Follow Us On: